Can I Afford my Goals?

According to the European Central Bank, household savings have reached historically high levels in advanced economies throughout the Covid-19 pandemic as people who have been working from home have had reduced costs of commuting and have spent less on eating out and entertainment.

Many investors have been more cautious during this period as there was increased uncertainty about some sectors of the economy so most of these additional savings were held in cash savings accounts at the end of 2020.

Only 10% of households that have increased their savings during the pandemic plan on spending these additional savings, with 70% planning on leaving them in cash and the rest planning to invest the additional savings or use them to pay off debts.

With very low interest rates from banks around the world, there is a risk that holding a large amount of cash could lead to the real value of people’s savings being eroded by inflation. Depending on what you plan to use your money for and when, there could be more efficient ways to use your funds. It is important that your money works for you.

Forth Capital offer cashflow planning as part of our ongoing service and this can help you to visualise the impact of investing your money or retaining it in cash. This can also demonstrate the impact of market events such as a market crash on your overall financial plan. But what is cashflow modelling and how can it help you?

WHAT IS CASHFLOW MODELLING?

Cashflow modelling pulls together your financial information such as your income, your current spending, and your assets. You can then project forward your future income and spending needs using reasonable assumptions. This can help you to visualise whether you are on track to meet your goals.

Using a cashflow model can help answer questions such as “Could I afford to stop working earlier than planned?”, “Can I afford to send my children to a fee-paying school?” or “How much do I need to save to buy a property with a value of £500,000 in ten years’ time?”

⠀

HOW CASHFLOW MODELLING WORKS

WHAT DO YOU WANT TO ACHIEVE?

Firstly, it is important to establish your goals and to put a cost figure on these goals.

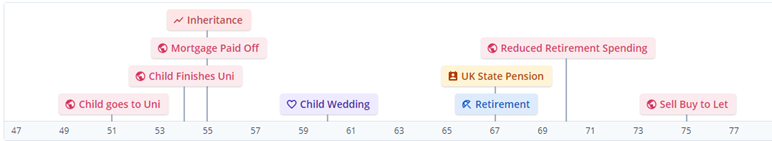

As an example, a 47-year-old single father, Stephen, with a daughter, Amy, who is financially dependent on him.

- He wants to retire at age 67 and to maintain his current outgoings of circa £56,000 p.a. until age 70, when he plans to slow down a little and reduce his spending to around £33,200 p.a.

- Stephen would like to pay off his main residence mortgage at age 55 (on track at current repayment rate)

- He plans to sell his buy to let property at age 75 to help fund his retirement.

- Stephen would like to support his daughter until she goes to university, and he expects this to cost £500 per month.

- He will also support her with her university fees and student rental accommodation, and he expects the total cost of this to be £15,000 p.a.

- Stephen would also like to help his daughter pay for her potential wedding should she want to get married, and he estimates that this could cost around £30,000 – he has estimated that he will be around 60 when his daughter gets married.

⠀

⠀

Once we have established key goals and timescales, we can input the key events into a timeline that will help you visualise your goals and their timescales.

WHAT IS YOUR INCOME AND SPENDING?

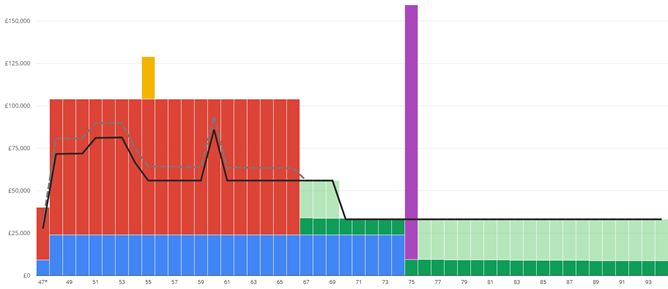

After considering the key goals and events as shown above and estimated the costs/ income associated with these periods we will account for your regular income and spending. When considering your outgoings, we will include periodic spending such as holidays and new car purchases to reflect how you spend your money.

We will then consider the contributions or withdrawals that you take from your investments including any pensions. If you are part of a workplace pension scheme which your employer contributes to, we can also include this in the model.

⠀

⠀

Based on your projected spending and income, we can project forward your income and outgoings to check that your current arrangement is sustainable and affordable based on our projection.

In the above example, you can see that Stephen’s spending, which is shown as the thick black line, goes up when his daughter goes to university and rises steeply in the year that he has projected his daughter may get married. The dotted line shows his spending including the contributions that Stephen is making to his savings and investments.

The coloured lines represent Stephen’s income, and in this example his income from work (in red) and rental from his buy to let rental income (shown in blue) covers his estimated spending with a surplus left over. You will note that there is additional income in the years that include events such as him selling his buy to let property at age 75 (in purple on the above graph).

After Stephen stops working, his income is covered by a combination of the assets that he has built up throughout his lifetime and the State Pension. It is therefore important that we include information about his assets in the financial plan.

WHAT ASSETS DO YOU HAVE?

In this example Stephen has the following assets that he can access at the start of the projection:

| Asset | Current value |

| Current Account | £ 20,000 |

| Cash Savings | £ 5,000 |

| Invested Regular Savings Plan | £ 50,000 |

| Employer’s Pension | £ 65,000 |

| Total | £ 140,000 |

Stephen in making contributions of £500 per month to his managed savings plan and he and his employer each contribute 4% of his salary to Stephen’s workplace pension.

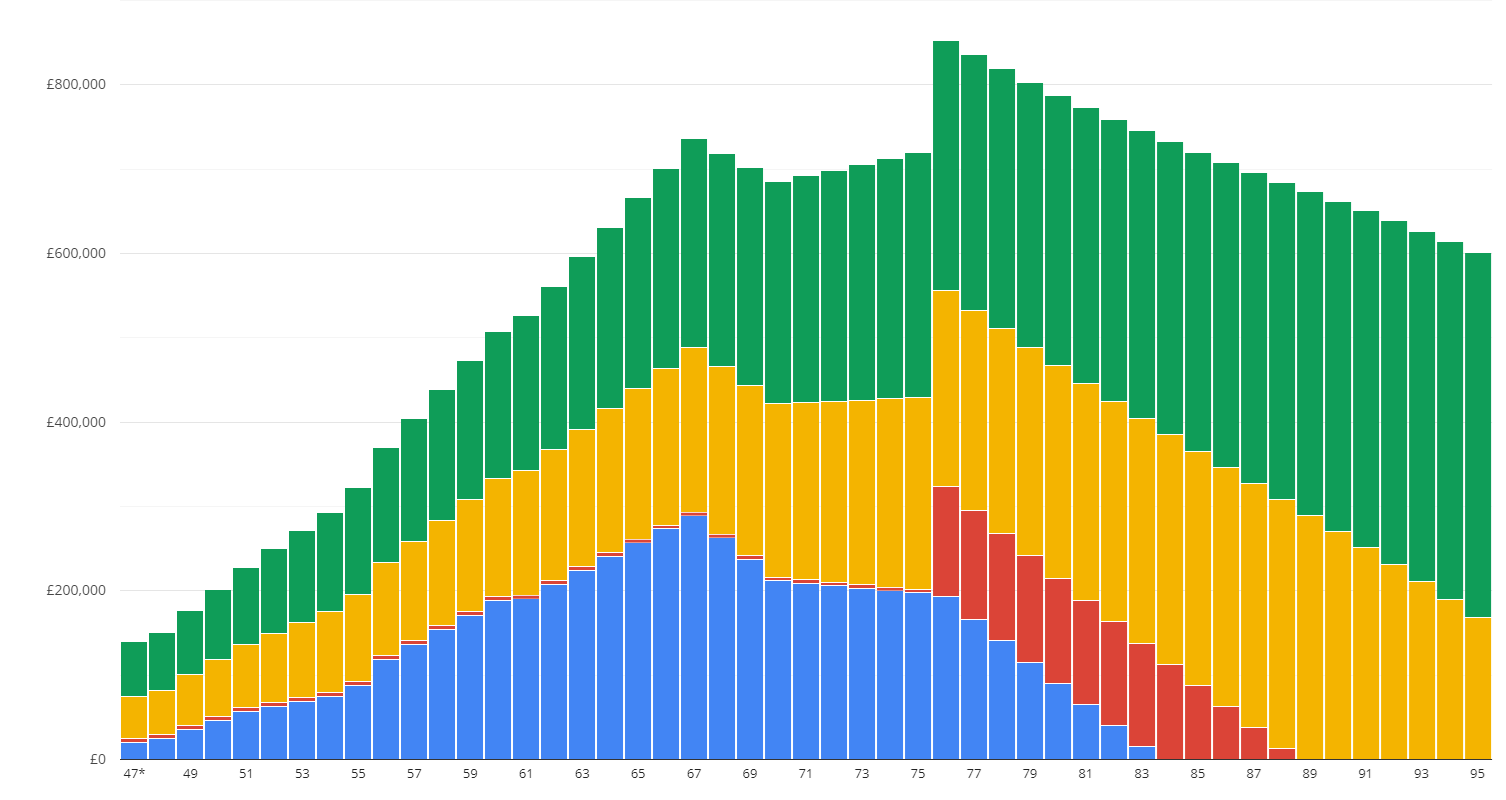

Based on the projected investment growth, contributions, income, and spending, we can project your savings position over time.

In Stephen’s case he is building up assets throughout his lifetime in his pension (in green on the above graph), Current account (blue on the above graph), savings account (red on the above graph) and managed savings plan (yellow on the above graph), and based on the projections, Stephen’s planning is on track for him to achieve his goals.

When we are projecting forward your financial plan, we will always base the initial projection on your finances as they are currently structured before considering making changes to your financial plan.

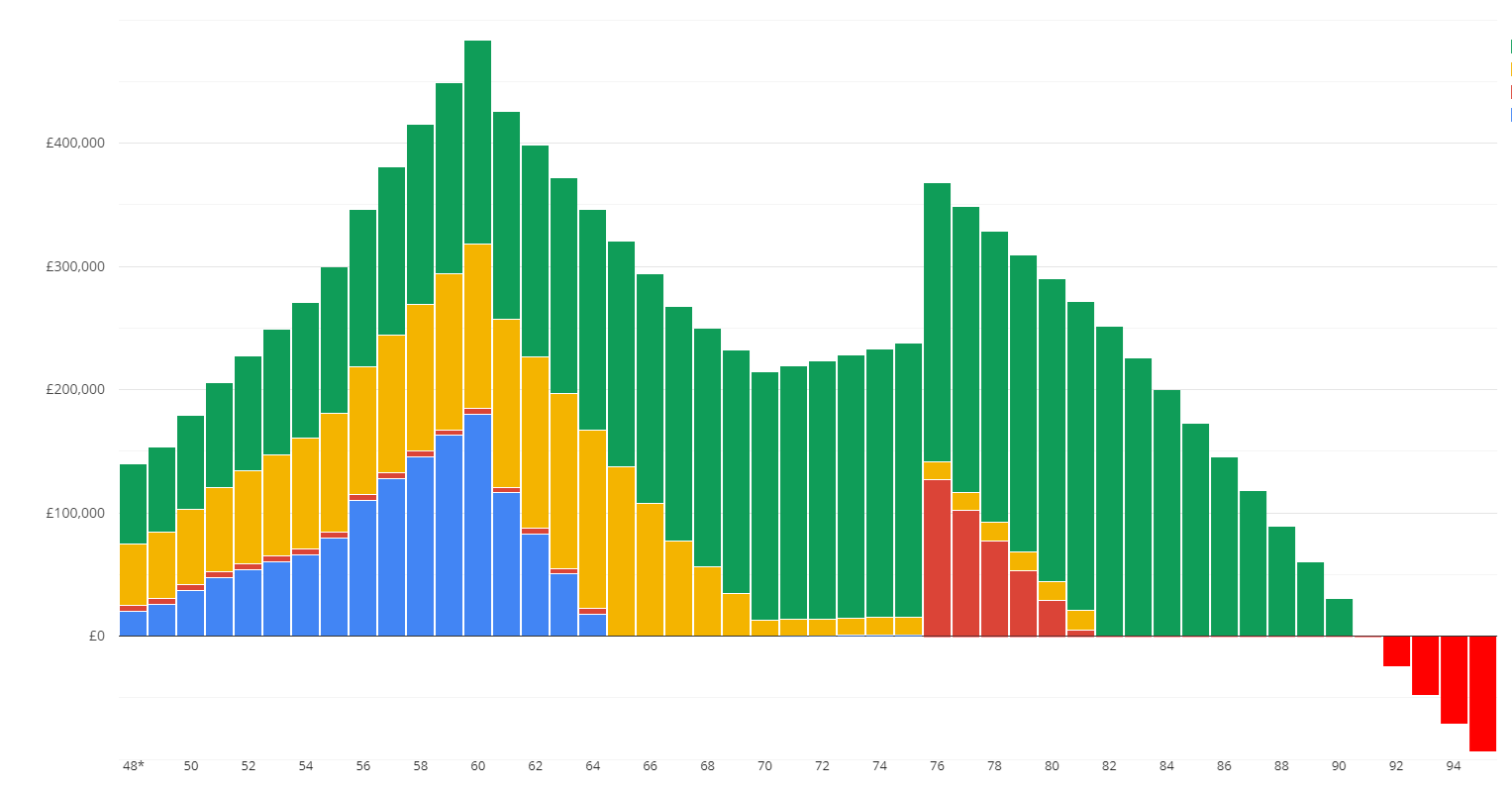

In the introduction, I outlined some of the key questions that we get asked when planning in this way. A common example is “could I afford to give up work earlier than planned?”

If we look at Stephen as an example, we could look at whether he could afford to retire at age 60 rather than at age 67. If all other details remain the same, Stephen’s projected savings look like this if he retires at age 60:

You can see from the above graph that if Stephen retires at age 60, he will have a funding shortfall from age 91. Identifying this shortfall at age 47 gives him time to consider the options available to him with his financial planner and identify a strategy to address this shortfall.

HOW CAN CASHFLOW MODELLING HELP ME?

Cashflow modelling is a great way of giving your finances a “health check” as well as keeping on top of your progress towards achieving your goals. Cashflow planning is not a one-off event, however, and your Forth Capital financial planner will review your plan on an ongoing basis as part of your annual reviews.

Cashflow modelling is not an exact science and is not designed to project the exact value of your assets at a future point as this is based on several assumptions and slight changes in these assumptions over a long period of time can lead to very different results. The purpose of the model is to demonstrate the impact of different strategies to help you achieve your goals.

Get in touch with us today to discuss your financial plan and how cashflow modelling can help you by clicking here.

Read more of our latest articles

Please complete the form below with your details and we will get back to you as soon as possible.