How 'Ikigai' Can Help You Plan Your Perfect Retirement

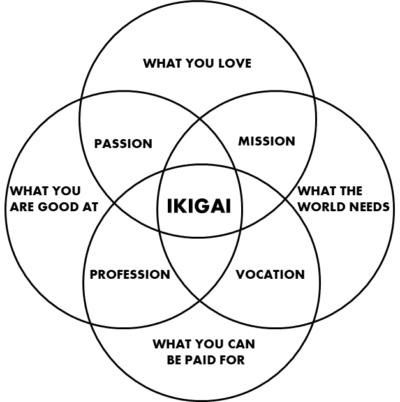

In Japanese, the term ‘ikigai' defines the powerful sense of purpose to be found through aligning your passions, your talents, and your career.

Translated literally, ‘iki’ means ‘life’ and ‘gai’ refers to 'value' or 'worth', so in professional terms this process of identifying one's ikigai can be a means of clarifying your 'reason for being'.

Perhaps unsurprisingly, defining each element, understanding its fundamental importance to you, and aligning each in turn, is an 'alchemy' that can potentially take years to achieve.

However, the sooner you start to explore this elegant concept, and what each of the respective elements means to you personally, the more likely you are to be able to successfully define your ikigai and put this insight into practice in a way that benefits your career and your retirement.

To kick off the process, it might help to sketch out a Venn diagram with four questions:

– What do you love doing?

– What are you good at?

– Does the world need it?

– Can you be paid for it?

Things that fall into that sweet spot in the middle, are where you’ll find your ikigai.

Why ikigai is important

Why are we talking about this? Well, it’s an important question when planning your retirement. This is because retirement is no longer as simple as it once was. We’re living longer and are much healthier for longer, which means that 'retirement' needn't actually mean stopping working altogether.

Conversations we’ve had recently with a world-famous tennis coach and an elite professional sportsman framed this idea in an interesting and useful way. Both talked about ‘retiring twice’ – effectively having your initial career, but then transitioning from that into a second career – potentially reinventing yourself to an extent and doing something you are passionate about.

This all sounds great in theory, but you may be wondering how to turn your ambitions into reality. This is where the value of planning a ‘hybrid retirement’ comes in.

Let’s take a look at what hybrid retirement actually is

The key thing to keep in mind is that hybrid retirement is all about retaining and embracing the parts of work that you find rewarding, whilst pivoting and dispensing with the aspects of your ‘initial career’ that you don’t enjoy.

It involves crafting a working lifestyle for yourself where you are in control of what you do, how much you do, when you do it, and who you do it with. You might not be able to score a perfect 10 on all of these variables, but that’s the aim.

There are many benefits to hybrid retirement

First and foremost, a hybrid retirement should allow you to craft a career based on your goals and passions, helping you identify and realise your ikigai.

Having the agency to choose what you do should also provide a greater sense of personal freedom, which can kickstart your passion for work again.

It should ideally afford you greater flexibility to dictate your schedule, meaning that you can spend more time with family and with friends, and more time to pursue other hobbies and interests.

Hybrid retirement will be different for every individual. For some it may be closely linked to their ‘first’ career, but in a different capacity. For example, a lawyer who works in a busy office may decide that they are fed up with their long commute or office politics. So they decide to become an independent consultant, providing expert advice on the same area of law except now they can work from home, choose how much work to take on, and have the free time to give some guest lectures at the local university.

Or you may do something totally different – and explore the opportunity to fulfil a lifelong dream that wasn’t possible at the start of your career, because other imperatives (such as achieving financial stability and independence) had to be prioritised.

If you own a business, hybrid retirement may involve finding someone else to take on the day-to-day management of the company to a greater extent, allowing you to increasingly step away from office-bound responsibilities whilst maintaining an income, but in a way that starts to become more ‘passive’.

It may take you a long time to find something you’re truly passionate about, but that may actually be a good thing. When deciding to pursue a passion later in life you are more financially able and emotionally confident to take on a new challenge. Having more life experience and a wider network of contacts can also help you succeed.

And the good news is your options for hybrid retirement are expanding as the internet, social media, and new technologies give you increasingly easy access to global marketplaces, making it simpler than ever to reach potential clients and run a business from home.

We can help plan your hybrid retirement

That being said, hybrid retirement of course presents many new challenges, and you’re likely to have many questions about it. You may wonder how your new venture will affect your saving goals, or have questions about the tax considerations if you were to set up a new business and become self-employed.

So, whether you know exactly what you want your hybrid retirement to look like, or perhaps have a number different ideas that could potentially fulfil your personal definition of ‘ikigai’, contact us if you’d like to discuss your thoughts, so that we can help you create a financial plan for your perfect retirement.

Read more of our latest articles

Please complete the form below with your details and we will get back to you as soon as possible.